With all the new responsibilities and routines it brings, the beginning of a school year is the perfect time to talk about and set up new chores at home. Chores help children learn valuable life skills and teach them to be independent and self-reliant teenagers and adults as they grow up.

Both of our boys have a list of age-appropriate chores they are in charge of daily. They started when they were toddlers, with simple things like asking them to pick up their toys and make their beds, and continued throughout the years. Now they help with dishes, vacuuming, cleaning their own bathrooms, and sorting their laundry.

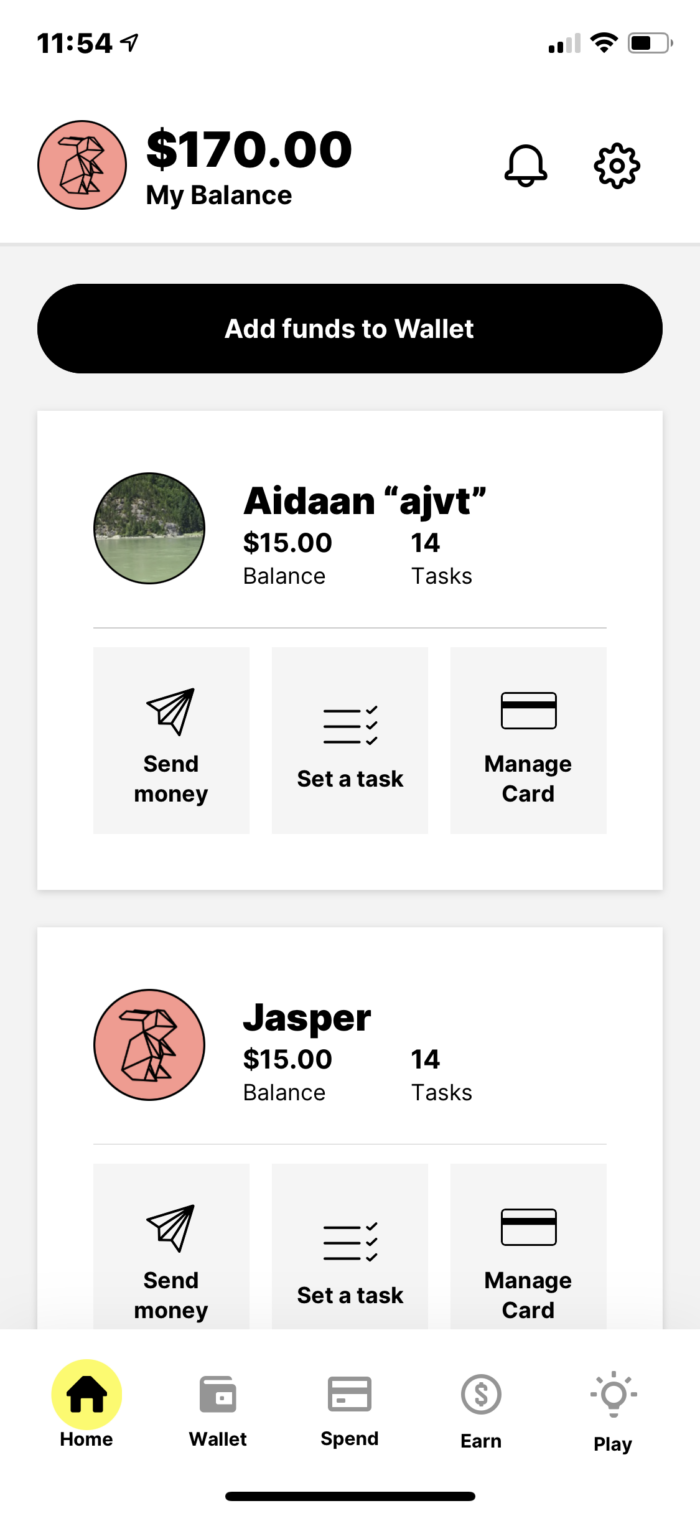

We recently started using the Mydoh app powered by RBC to manage their chores, allowance, and more, and I am excited to share more about it today.

In our household, we handle chores and allowance differently in terms of payment.

The boys don’t get paid to help with the family housework and do their basic daily chores. We believe that they need to feel like they are contributing to our family because they are part of the family and not just because they are interested in the money they get after doing their chores.

They still get a weekly allowance, but it isn’t in exchange for them doing their basic chores, and they can earn extra allowance when helping with other tasks outside of their basic family chores.

For the longest time I had been depositing their allowance money into their own bank accounts, and anytime they wanted to buy something, they would ask me to pay for it with my own money and discount it from their account. That approach was working for us, but I felt like they were a bit disconnected from the process and not really learning a lot about making financial decisions and money management on their own.

Enter the brand new Mydoh app. This app is a fantastic money management tool that helps families manage chores/allowance and teaches children about financial literacy while safely providing them with some financial independence.

Signing up for Mydoh is easy!

First, the parent downloads the app, authenticates their details, and sets up accounts for each child.

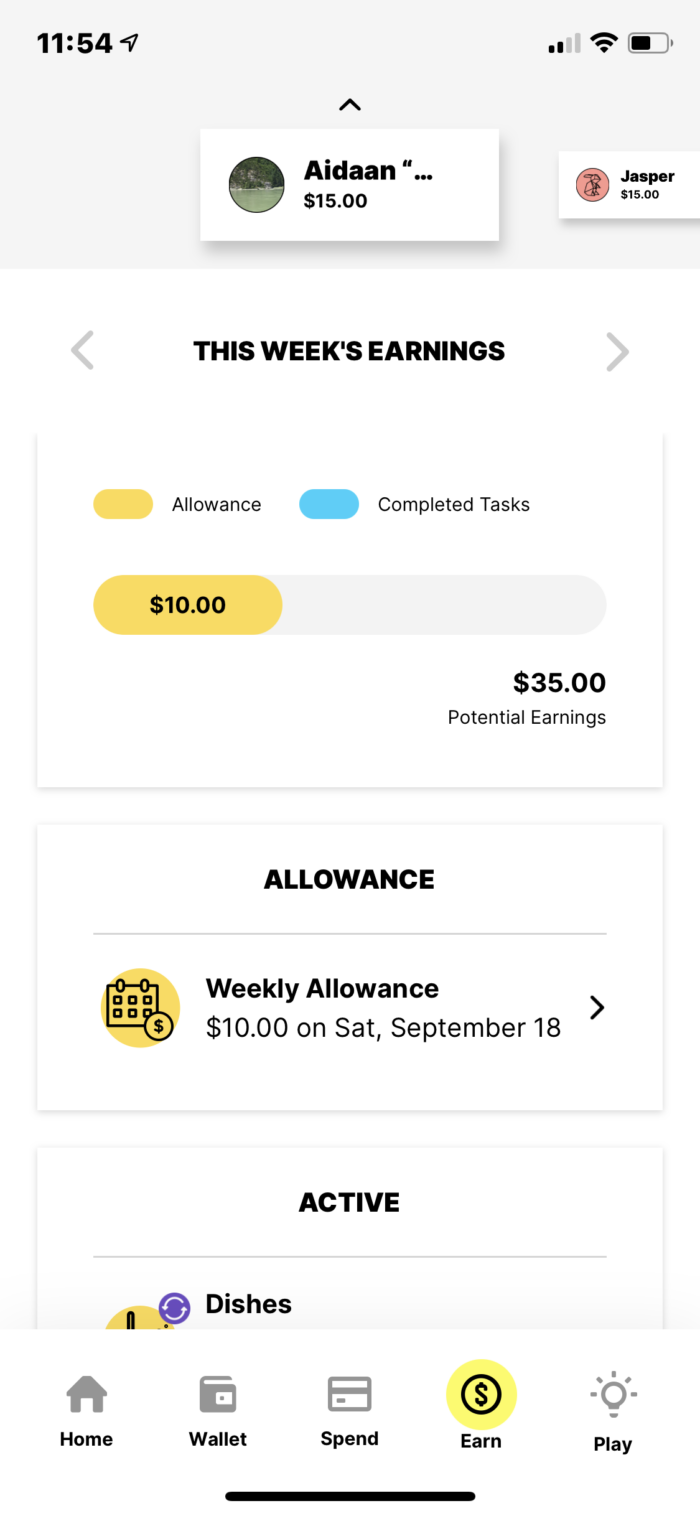

After that, you can download the app on the child’s device, and they can manage their account to access a daily list of chores, track their earnings, and access their Smart Cash Card, a prepaid Visa card to pay online or in-person.

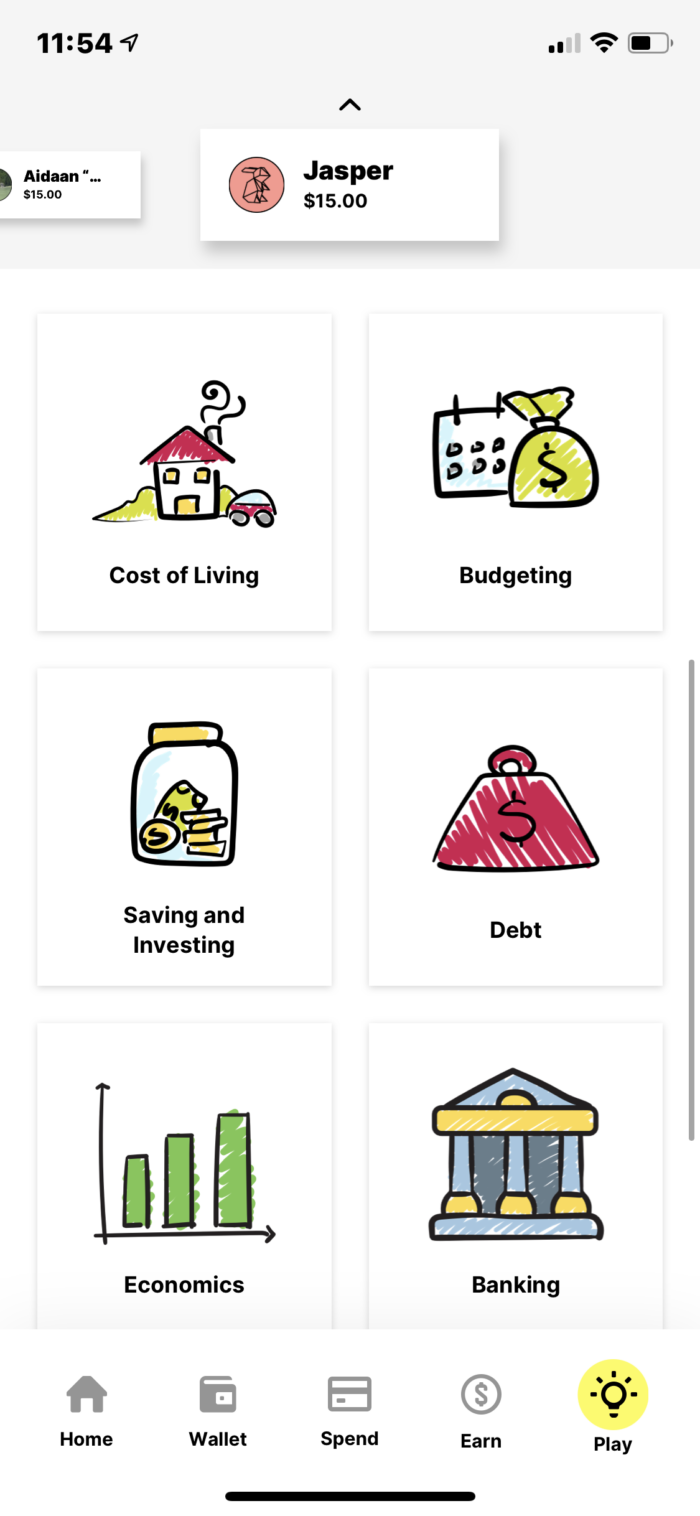

In addition, the fun trivia games get kids excited to learn about financial literacy, smart spending, saving, and more.

Parents who sign-up for a new Mydoh account from now until Dec. 31, 2021 and use the code ANGELA10 will receive $10 to use in their account.*

The parent account.

As a parent, setting the parent account is simple.

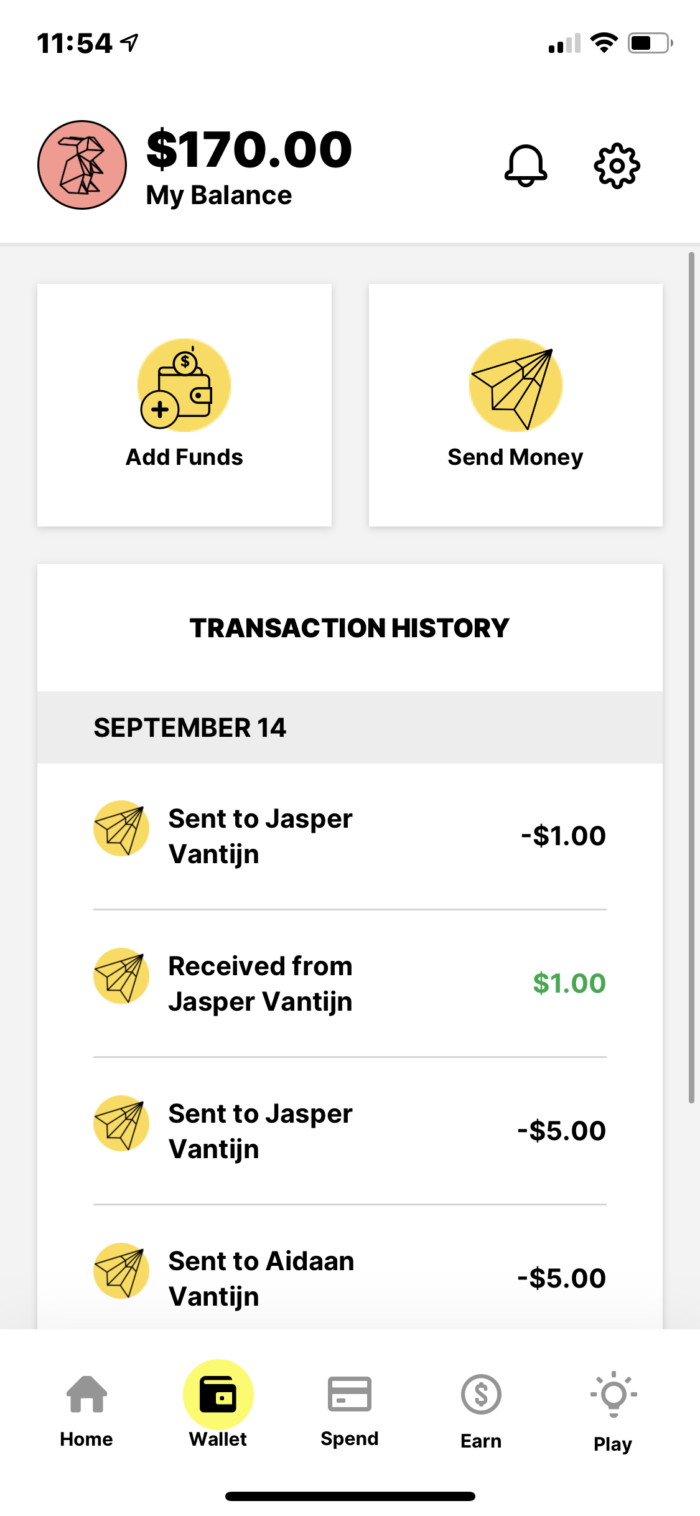

First, you can sign up using your RBC Online Banking login or government ID to verify your identity. After that, you can set up tasks and allowance, send money to your child instantly within allowable limits, track their earnings and spending, lock and unlock their cards, and more.

Children get paid on Pay Day every Saturday, and it all happens automatically. I love not having to think about it every week anymore. I used to forget to pay them before, and now it happens automatically, so I have something less to worry about.

The child account.

Children can use the app to manage their chores, mark them as complete, spend money using their Smart Cash Card (up to the allowable limit set by their parent), track their earnings, spending, and balance, and learn money basics while playing.

You can also request a physical card, called the Smart Cash Card, that will arrive by mail and can be used to pay online or in-store. With their Smart Cash Card, kids can make purchases online and in-store, anywhere that Visa is accepted.

We are now using the Mydoh app with the boys, and they were so excited when we set it up. They love keeping track of their earnings, what they are spending, and what they are saving. They are also super excited to have their own VISA cards with their names on them.

I also really like that they have more independence to make their own decisions, and I can easily “react” to their purchases within the app and have conversations with them after they make a purchase. I have a conservative spending limit set up on their card, and they know what kind of things they are allowed to purchase, either online or in person.

They also understand that I will be increasing this limit as they mature, and they show me that they are learning how to manage, spend, and save their money.

Children need to learn to manage their money, starting with small amounts, making mistakes even while gaining life experience in a safe environment. Knowing that they are receiving support and you are still able to supervise them.

The money trivia games are also one of their favourite things in the app. It is a fun way to get the conversation started. I love when the boys play it, and I get the results of the trivia. I can then easily focus on the questions they didn’t get right and dive into the conversation, explaining the correct answers. They see it as a fun game, and it is a great learning opportunity.

Something new I noticed happened after we started using the Mydoh app was that they were more excited to complete their chores, as they were marking them done in the app, and they knew they were excited for Pay Day every Saturday. The app makes it easy to keep track of everything in one place. For example, one of my youngest’s chores is the main floor every couple of days. So the other day, I woke up to him vacuuming the floor before school. He just said, ” I just wanted to mark it as done in the app before I go to school”. I love that!

Thanks to the Mydoh app, children can learn about money management through hands-on, real-world experience, gaining competence and confidence while building a healthy relationship with money.

I highly recommend you download the Mydoh app and set it up with your family.

Financial literacy is so important, and learning about money should start from an early age. You can visit mydoh.ca for more information.

*Offer Terms and Conditions

Offer of $10 deposited in your Mydoh Wallet with one-time use promo code ends Dec 31/21. New Mydoh users only. Apply promo code when prompted on initial sign-up. Offer to be added to your Mydoh Wallet within 1 days of sign-up. Offer can be changed or withdrawn at any time.

31 Comments on “Teaching Kids About Financial Literacy”

This is so cool! I will download it for my kids too!

Yay! let me know what you guys think! 🙂

This is such an interesting idea! I would definitely consider using something like this.

Very useful! The kids love it too.

That is a very cool concept! There is an app for everything these days. It’s helpful!

Yes! So very helpful! 🙂

This sounds like a fantastic way to get kids saving and understanding their money more. Appreciate the extra $10 too!

It is such a great app! Glad you can take advantage of this promo 🙂

oh wow!! now this is one of the smartest ideas I have seen! ! especially since everything is so tech based and is the way of our world now. Great way to motivate kids to help around the house and learn and grow

Such a great way to build math skills, and life skills too!

This looks pretty slick! Going to recommend to my brother who has younger kids 🙂 They would be really into it!

This is awesome!

This looks like a really cool app for kids.

The Mydoh app is genius! I love this idea.

wow! great tool! i really wish they taught more financial advice to children in school!

What a great idea and App! My own kiddos are beyond the age of needing this, but I will definitely advice my BFF of this.

What a great app to teach kids about financial literacy

This is such a great idea I can see how that would be beneficial. I find young adults these days are not as money smart.

This sounds like an awesome app. I love anything that helps and teaches the children about financial responsibility

So very important!

This is really awesome. I will be downloading it for my kids. Finance is a great thing to learn for kids especially since they do not learn it at school.

I agree kids shouldn’t be paid an allowance for doing shores, as a family you all have to work together to get things done. I do like the app where can keep track of how much money they have as seeing it gives them power and they learn the value of money.

Great info here. Very important for kids to know.

This is a great idea . Good way for kids to understand money better

This looks like a great app to start teaching kids about finances which is very important to learn about.

I really enjoyed reading this guide. It was very informative and offered a lot of helpful tips for parents. The information is easy to understand and will help parents teach their kids about financial literacy in an easy way!

What a great app. Teaching children financial responsibility is so important.

That app is perfect for our family. Thanks for highlighting the features of it! Looks great!!

This sounds like a wonderful app. I believe that kids should learn about finances and budgeting, saving etc.

New to me Great app. Teaching children financial responsibility. I am sending this to my son and his kids

I wish they taught financial literacy in schools!